BLA Wealth Link

And increase investment amount with ad-hoc top-up premium

Up to 150% of the single premium, ensuring your family’s financial security

Increase your chance of achieving returns by investing in diverse mutual funds, while customizing your portfolio based on your acceptable risk profile

Issued age Issued age |

Newborn – 70 |

|---|---|

Coverage period Coverage period |

Until age of 99 |

Sum assured Sum assured |

Up to 150% of the single premium* |

Regular Premium Regular Premium |

Pay single premium |

Enhance opportunities of wealth growth Enhance opportunities of wealth growth |

There is no Premium Charge for a single premium payment, allowing you to invest nearly full amount of your premium. |

*of single premium payment for all cases of death, according to the company’s term and conditions

Note : BLA Wealth Link is the marketing name of BLA Wealth Link Unit Linked insurance with single premium payment.

| Issued age | Newborn – 70 |

|---|---|

| Coverage period | Until age of 99 |

| Premium payment period | Single |

| Premium payment mode | Single |

| Single premium | Minimum: 50,000 baht Maximum: up to 30 million baht (including all BLA Wealth Link Unit Linked policies with single premium per 1 insured person) |

| Ad-hoc Top-up Premium | Minimum: 10,000 baht per time Maximum: Up to 10 times the single premium or 120 million baht per policy year. |

| Sum assured | Depend on age

|

| Death benefits | In the event of the insured's death while age not more than 60, the company will pay benefits amount whichever is the higher between 1. or 2.

In the event that the insured dies at the age of 61 or above, the company will pay benefits amount whichever is the higher between 1. or 2.

|

| Survival benefits | Receive the redemption value of investment units, and all investment units will be sold on the valuation date after the maturity date. |

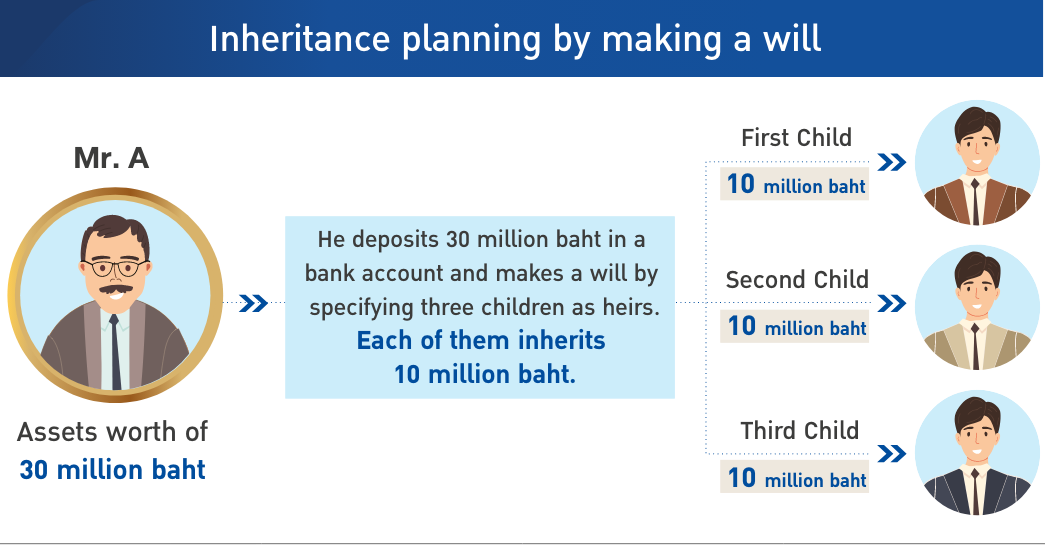

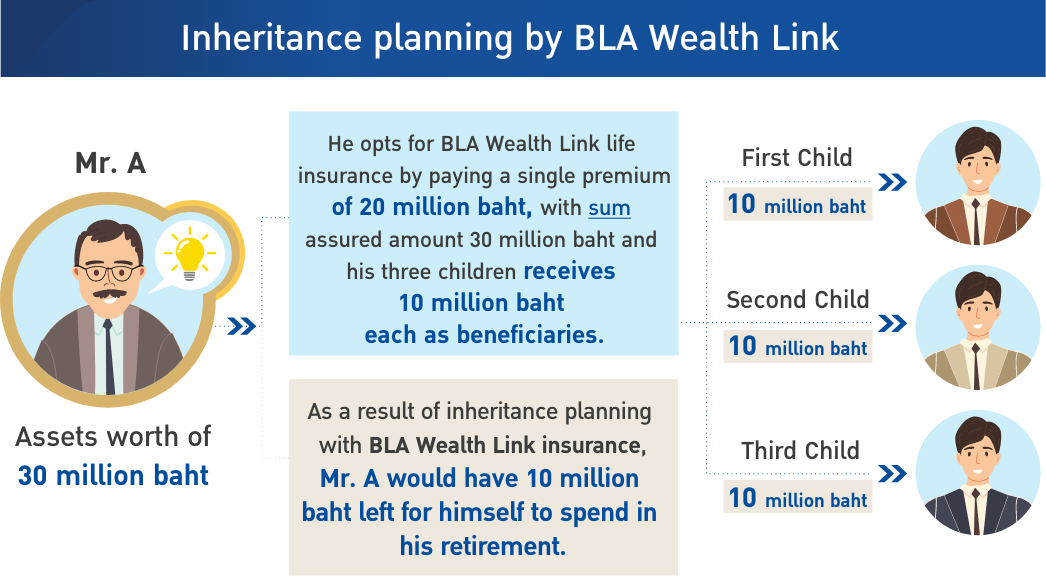

Financial Stability Planning. Get ready to pass on inheritance with BLA Wealth Link

Example: Mr. A, a 50-year-old business owner owning assets worth 30 million baht. He plans to divide these assets equally among his three children, 10 million baht each, in case of his death.

Note:

- In the event of the insured's death while age not more than 60, the company will pay benefits 150% of the single premium. In the event that the insured dies from age of 61, the company will pay benefits 110% of the single premium (See table of Important features).

- The listed insurance premiums and sum assured are designed to illustrate the plan only.

Completeness of the insurance contract

Knowingly providing false or misleading statement on the insurance application may result in the company increasing the Cost of Insurance and insurance premiums and rejecting the application, if discovered later. Under Section 865 of the Civil and Commercial Law, any contract obtained through such information is invalid, in which the company may void the contract and deny all policy payouts. In such cases, the company’s liability is limited to returning the investment unit redemption value, any premiums paid for separate rider coverages (if any), and paid policy fee except those for financial reports.

The company will not pay the following cases:

- In the event the insured commits suicide within one year from the effective date of the insurance policy, or upon renewal, or upon reinstatement, or upon the date the company approves the increase of the sum assured only for the additional part.

- In the event the insured is murdered by the beneficiary.

- In the event the declaration of age is incorrect and inaccurate that the actual age is outside the standard premium rate.