ADVANTAGES

It is a guarantee for the family of the assured in the event of death or total permanent disability of the assured as the family does not have to bear the burden of the debts and the ownership of the property will still belong within the family.

The premium is cheaper than all insurance plan with similar coverage character.

Since the policy is single premium you never have to worry that the policy will be lapsed.

The life insurance premium is personal income tax deductible in according to regulations stipulated by the Department of Revenue for 10-year term assurance or over

- Must be a customer of a financial institution for housing loan

- Insurable age 20 - 69 years old

- The borrower's age when added to the duration of the loan must not exceed 70 years old

| COVERAGE | BENEFITS |

|---|---|

| 1. Death | In the event of death of the assured and the company has received the complete proof of death/death certificate of the assured according to the forms and procedures specified by the company, the company will pay a benefit amount equal to the assured sum of the month of death of the assured according to the reduced sum assured specified in the schedule to the primary beneficiary. The mentioned amount will not exceed the amount of outstanding debts by the assured to the primary beneficiary at that time. Any remaining assured amount will be paid by the company to the secondary beneficiary as specified in the policy in the specified proportion or in equal amounts if the proportion has not been specified except there has subsequently been an alteration in secondary beneficiary/ies and the assured has notified the company in writing of the said alteration, accompanied by supporting documents as indicated by the company. |

| 2. Total permanent disability |

2.1 In the event of total permanent disability by the assured and the disability has occurred continually for not less than 180 days, the company will pay the assured sum of the month that the assured has incurred the total permanent disability according to the reduced sum assured indicated in the schedule, and this policy shall no longer be inforce immediately. 2.2 In the event of total permanent disability by the assured from a loss which can be clearly proved or there are clear medical indications of total permanent disability by the assured, the company will pay the benefit amount in this event at the full assured sum of the month of the start of the total permanent disability of the assured according to the reduced sum assured indicated in the schedule, and the policy shall no longer be inforce immediately. Payment of benefit amount in the event of total permanent disability will be made by the company to the primary beneficiary, but the amount will not exceed the amount of outstanding debts by the assured to the primary beneficiary at that time. Any remaining assured amount will be paid to the assured. |

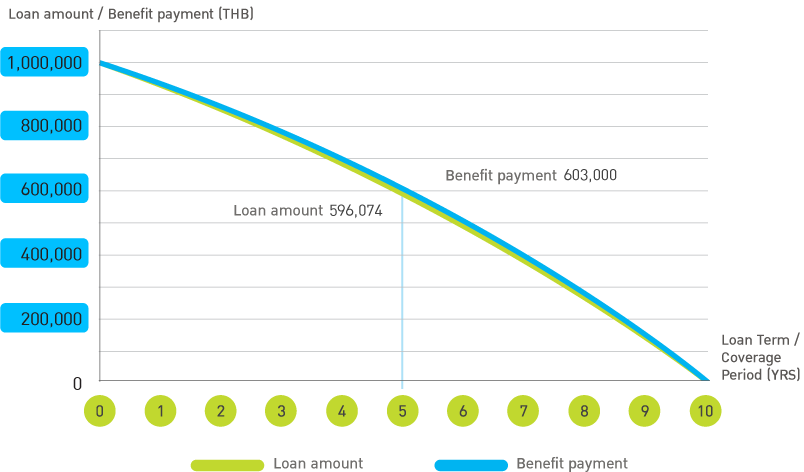

In the event the customer applied for an assurance which the sum assured and coverage period are equal to the loan amount and loan term, the benefits to be paid by the company (according to the reducing sum assured) will cover the outstanding debts of the customer.

Example : A customer applied for a housing loan in the amount of 1,000,000 THB for a 10-year loan term, at the MLR (Minimum Loan Rate) of 7.13%* while holding an assurance with sum assured of 1,000,000 THB for a coverage period of 10 years. From the graph, the benefits to be paid by the company will be more than the debts.

*The MLR rates between 6.75 and 7.13% (Information from the Bank of Thailand, as of February, 2015)

In case of a female customer, 30 years old, applying for assurance at the sum assured of 1,000,000 THB for a coverage period of 10 years, the customer will pay a single premium of 8,180 THB.

Please contact our life insurance agents or financial advisors nationwide. Call: 02-777-8888