This endowment insurance with dividend suitable for those who want...

- Make a life plan to create insurance and stability in the future

- Investment plan for more returns and the principal is not lost

- Planning for children's education - building a family for the education of your beloved child

- Tax deduction plan premiums are eligible for personal income tax deduction

- Plan for business for planning to expand the business to grow

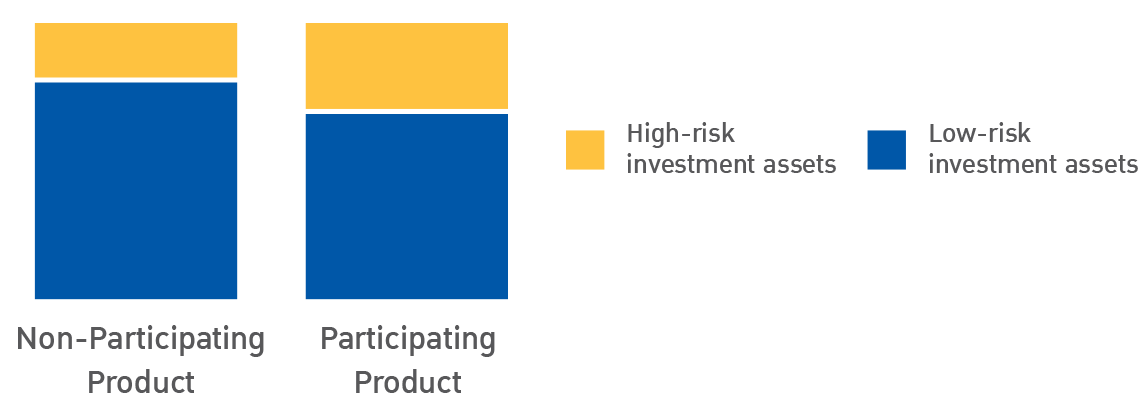

To meet the needs of planning in each aspect of life, the endowment insurance with Par is designed to improve your chances of generating higher returns with investment proportion in assets which are different from Non-Participating Product by increasing the investment proportion in high-risk assets along with managed with a dedicated investment portfolio. Expertise and efficiency for aiming in good and appropriate returns in each period.

Comparison of Investment Proportion between Non-Participating and Participating product

Investment Strengths

Separated investment portfolio*

Participating product portfolio provides investment flexibility for higher chance of receiving higher returns with minimum guarantee return

Bottom-Up analysis

For better investment decisions, this results in good and appropriate returns in each period of time

Manage and monitor investment portfolio

By experts and efficient management system

* To increase the opportunity to receive higher returns, the company has a policy to invest in high-risk assets for Participating Product in a higher proportion than Non-Participating Product. High-risk assets include common stocks and real estate funds both domestically and internationally, including businesses with long-term high growth prospects such as those in the technology and health sectors.

This life insurance is suitable for all working and salaried people who do not want their income to lie still in their bank accounts, the people who are looking for investments that can increase their income for their other future plans. This insurance plan meets all the needs of working people: BLA Happy Saving 14/7 (Par); Pay premiums as short as 7 years, receive life coverage for 14 years with a guaranteed annual returns, and increase chances of receiving dividends.

.png)

- Insured age : 0 to 70 years

- Initial sum assured : 50,000 baht

- Annual premium payment

- Insurance underwriting is in accordance with the company's criteria

- Additional riders can be purchased, according to the conditions set by the company

- In the case of not purchasing additional riders, no examination and no health questions are required

.png)

| Alive | Deceased |

|---|---|

| On the 1st - 5th policy anniversary, receive 2% annual cash return | The 1st policy year, receive 100% cash return |

| On the 6th - 10th policy anniversary, receive 4% annual cash return | The 2nd policy year, receive 200% cash return |

| On the 11th - 14th policy anniversary, receive 8% annual cash return | The 3rd policy year, receive 300% cash return |

| On maturity date, receive 700% cash return | The 4th policy year, receive 400% cash return |

| Total benefits throughout the contract of 762%, with a chance to receive dividends[3] | The 5th policy year, receive 500% cash return |

| The 6th policy year, receive 600% cash return | |

| The 7th -14th policy year, receive 700% cash return | |

| (% of the sum assured) | (% of the sum assured or actual accumulated life insurance premiums paid, whichever is higher) |

A 40-year-old male in good health, with a 100,000 baht sum assured.

He pays an annual premium of 98,800 baht and has a personal income tax rate of 20 percent throughout the contract period.

Unit: Baht

| Policy Year | Annual Insurance premium (at the commencement of policy year) |

Cash return benefit at policy anniversary | Life Coverage | Policy surrender value | Total eligible cash return before maturity | Tax benefits | ||

|---|---|---|---|---|---|---|---|---|

| % of the sum assured | Amount | % of the sum assured | Amount | |||||

| 1 | 98,800 | 2% | 2,000 | 100% | 100,000 | 22,100 | 24,100 | 19,760 |

| 2 | 98,800 | 2% | 2,000 | 200% | 200,000 | 77,300 | 81,300 | 19,760 |

| 3 | 98,800 | 2% | 2,000 | 300% | 300,000 | 190,200 | 196,200 | 19,760 |

| 4 | 98,800 | 2% | 2,000 | 400% | 400,000 | 290,500 | 298,500 | 19,760 |

| 5 | 98,800 | 2% | 2,000 | 500% | 500,000 | 409,800 | 419,800 | 19,760 |

| 6 | 98,800 | 4% | 4,000 | 600% | 600,000 | 499,100 | 513,100 | 19,760 |

| 7 | 98,800 | 4% | 4,000 | 700% | 700,000 | 590,400 | 608,400 | 19,760 |

| 8 | 4% | 4,000 | 700% | 700,000 | 604,800 | 626,800 | ||

| 9 | 4% | 4,000 | 700% | 700,000 | 619,500 | 645,500 | ||

| 10 | 4% | 4,000 | 700% | 700,000 | 634,700 | 664,700 | ||

| 11 | 8% | 8,000 | 700% | 700,000 | 650,300 | 688,300 | ||

| 12 | 8% | 8,000 | 700% | 700,000 | 666,400 | 712,400 | ||

| 13 | 8% | 8,000 | 700% | 700,000 | 682,900 | 736,900 | ||

| 14 | 708% | 708,000 | 700% | 700,000 | 700,000 | 762,000 | ||

| Total | 691,600 | 762% | 762,000 | - | - | - | - | 138,320 |

- The value of cash return benefits, policy surrender, and eligible cash return before maturity of the contract are based on the value calculated on policy anniversary.

- The eligible cash return before maturity is the sum of the cumulative amount of cash received back, combined with the amount of policy surrender value, calculated on policy anniversary. However, as of the date of surrender, the insured will be assigned the policy surrender value only.

Unit: Baht

| Summary of policy benefits (including dividends) | In case of no dividend payment | Examples of dividends from average return on investment throughout the contract[3] | ||

|---|---|---|---|---|

| 3% | 4% | 5% | ||

| 1. All annual cash return benefits of the 1st - 14th policy anniversary | 62,000 | 62,000 | 62,000 | 62,000 |

| 2. Maturity cash return at the 14th policy anniversary | 700,000 | 700,000 | 700,000 | 700,000 |

| 3. Chance to receive dividends upon maturity[3] (Non-guaranteed benefits payment) |

- | 76,390 | 133,000 | 187,000 |

| 4. Benefits throughout the contract (1.+2.+3.) | 762,000 | 838,390 | 895,000 | 949,000 |

| 5. Total premiums paid of 7 years | 691,600 | 691,600 | 691,600 | 691,600 |

| 6. Benefit value that exceeds the paid premiums (4.-5.) | 70,400 | 146,790 | 203,400 | 257,400 |

| 7. Benefit from 7 years tax deductions | 138,320 | 138,320 | 138,320 | 138,320 |

| 8. Benefit value that exceeds the paid premiums (Including tax deduction benefits (6.+7.)) |

208,720 | 285,110 | 341,720 | 395,720 |

[3] The company may consider paying dividends upon maturity to the insured; such dividends are based on the return on investment of the assets of the dividend-paying product portfolio over the contract period after deducting all costs of the insurance policy. The company will allocate the 80 percent to the insured, and the dividend at the maturity of this contract is different for each product. This is in accordance with the conditions, requirements, and dividend calculation methods provided by the company.

BLA Happy Saving 14/7 (Par)

- In the event that the insured does not disclose the true statement or makes a false statement, the company will void the contract within two years from the effective date of the coverage under the insurance policy, or upon renewal, or upon reinstatement, or upon the date the company approves the increase of the sum assured only for the additional part. Unless the insured does not have a stake in the insured event, or the declaration of age is inaccurate that the actual age is outside the normal trade premium rate limit.

- In the event the insured commits suicide within one year from the effective date of the insurance policy, or upon renewal, or upon reinstatement, or upon the date the company approves the increase of the sum assured only for the additional part, or if murdered by the beneficiary.

Note

- This advertising media is only a summary of preliminary benefits. Please read the details of the coverage conditions and exclusions before deciding to purchase any insurance products. The coverage conditions and complete exclusions can be inquired from your agents or from your life insurance policy details.

- Remittance of insurance premiums is the responsibility of the insured. The fact that life insurance agents and brokers offer to collect insurance premiums is a service only.

- A health declaration is one of the factors for underwriting and benefits payment consideration.

- For maximum benefits from the policy, the insured should pay premiums until the premium payment period completes and hold the policy until its maturity.

- BLA Happy Saving 14/7 (Par) insurance premiums and health insurance premiums (if any) can be used for personal income tax deductions, according to the criteria set by the Revenue Department.