| Unit : Baht | |||||

| Coverage | PA Aunjai Ruk Plan 1 | PA Aunjai Ruk Plan 2 | |||

|---|---|---|---|---|---|

| Occupation Class 1 | Occupation Class 2 | Occupation Class 1 | Occupation Class 2 | ||

| 1. Loss of life, dismemberment, loss of sight | 500,000 | 500,000 | 1,000,000 | 1,000,000 | |

| 2. Total Permanent Disability | 500,000 | 500,000 | 1,000,000 | 1,000,000 | |

| 3. Murder or assault | 250,000 | 250,000 | 500,000 | 500,000 | |

| 4. Death due to driving or riding on motorcycle | 250,000 | 250,000 | 500,000 | 500,000 | |

| 5. Public Holiday accident coverage (additional payment to No. 1) | 500,000 | 500,000 | 1,000,000 | 1,000,000 | |

| 6. Medical fee per each accident | 50,000 | 30,000 | 100,000 | 50,000 | |

| 7. Benefits from broken bones, burns, scalds, and injury to internal organs | 10,000 | 5,000 | 10,000 | 5,000 | |

| 8. Daily compensation for hospitalization | |||||

|

500 | 500 | 1,000 | 1,000 | |

|

1,000 | 1,000 | 2,000 | 2,000 | |

| (altogether not exceeding 365 days maximum per each injury) | |||||

| 9. Accident coverage while traveling in a private automobile (additional payment to No. 1) | 500,000 | 500,000 | 1,000,000 | 1,000,000 | |

| 10. Funeral expense benefits | 5,000 | 5,000 | 10,000 | 10,000 | |

| 11. Public accident coverage (additional payment to No. 1) | 500,000 | 500,000 | 1,000,000 | 1,000,000 | |

| Annual Premium Payment | |||||

| Age 0 - 60 years old | 2,888 | 4,888 | |||

| Age 61 - 65 years old | 3,465 | 5,865 | |||

| Age 66 - 70 years old (extension) | 4,040 | 6,840 | |||

- Private automobile means private automobile and private trucks/pickups which are not used for transport according to the Land Transport Act.

- Public accident means an accident which occurs to the Insured while the Insured is a passenger in a train, skytrain, subway, public transportation bus, minibus, Borkorsor transport bus, affiliated Borkorsor transport bus, affiliated public transportation van, public elevator or while there is a fire in a public building when the Insured is present.

- Funeral expense benefits means expenses connected with arrangements of a funeral which include funeral expenses, cremation or burial and other necessary expenses which the Company pays to the beneficiary in case the Insured dies from an illness.

- Insurance premium will be adjusted according to the specified span of age as per the rates approved by the Office of Insurance Commission.

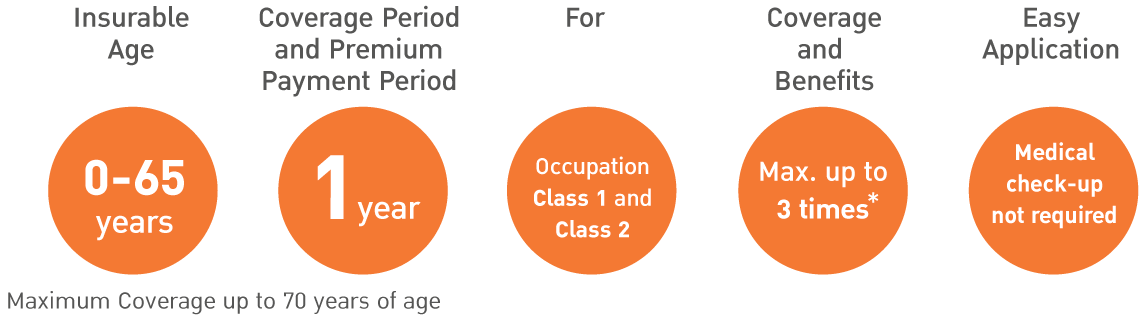

*Receive up to 3 times’ maximum coverage and benefits in case

1. Death is the result of accident while traveling in a private automobile on a public holiday, or

2. Death is the result of a public accident which occurs on a public holiday.